Online News Analysis - Predicting Media Shares by Article Characteristics ================ Matt Kasle 10/15/2020

friday articles

Introduction

This dataset summarizes a heterogeneous set of features about articles published by Mashable in a period of two years. The goal is to predict the number of shares in social networks (popularity).

There are 61 attributes, 58 which are predictive attributes, 2 of which are non-predictive (url and timestamp), and 1 that is the target.

The types of veriables include the number of words in the article, the number of words in the title, the positivity and sentimentality of the article, the article’s subject, the number of keywords used, and much more.

The objective of this project is to predict the number of social media shares using two different tree-based algorithms. The first algorithm will be a non-ensemble regression tree, and the second algorithm will be a boosted trees algorithm, which is a state-of-the-art classification technique.

The other objective of this project is to create an automated report that outputs the classification analysis for each articles published on each weekday.

The required packages to run this analysis are tidyverse, caret, tree, and patchwork.

Data

First, we need to read in the data and set up the subsetting of the data into a single weekday. Then, we’ll split the data set to a training and test set for training and evaluating the classificaiton models. A 70/30 train-test split will be used.

set.seed(1)

library(tidyverse)

library(caret)

library(tree)

news <- read_csv("OnlineNewsPopularity.csv")

varDayOfWeek <- parse(text=paste0("weekday_is_", params$day_of_week))

news <- news %>% filter(eval(varDayOfWeek) == 1)

news <- news %>% select(-url, -timedelta, -weekday_is_monday, -weekday_is_tuesday, -weekday_is_wednesday,

-weekday_is_thursday,-weekday_is_friday,

-weekday_is_saturday, -weekday_is_sunday, -is_weekend)

newsIndex <- createDataPartition(news$shares, p = 0.3, list = FALSE)

newsTrain <- news[newsIndex, ]

newsTest <- news[-newsIndex, ]

Summarizations

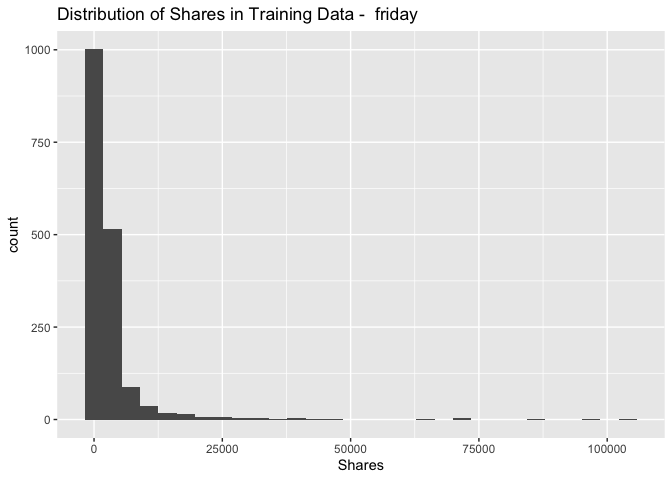

Below are summary statistics of the online news data set, such as the number of observations in the train set, a numerical summary of the response variable (number of social media shares), a distribution of the response, and relationships between the response and interesting variables in the dataset.

Number of rows in training set:

nrow(newsTrain)

## [1] 1711

Summary of response variable:

summary(newsTrain$shares)

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 70.0 973.5 1500.0 3218.1 2700.0 104100.0

It is important to make note of the minimum and maximum of the response variable, as well as the median and quartiles. For future analysis, it may be best to remove outliers.

Distribution of response variable:

ggplot(data = newsTrain, aes(x = shares)) +

geom_histogram() + xlab("Shares") + ggtitle(paste("Distribution of Shares in Training Data - ",

params$day_of_week))

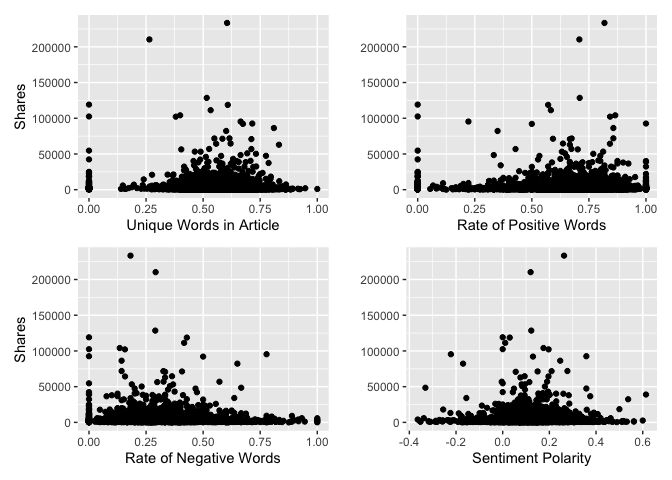

Below is a plot of four interesting variables to the response variable, shares. We want to see if there are any intersting patterns here.

library(patchwork)

par(mfrow=c(2,2))

plot1 <- ggplot(data=news, aes(x = news$n_unique_tokens, y = shares)) + geom_point(stat = "identity") +

labs(x="Unique Words in Article", y="Shares")

plot2 <- ggplot(data=news, aes(x = news$rate_positive_words, y = shares)) + geom_point(stat = "identity") +

labs(x="Rate of Positive Words", y="")

plot3 <- ggplot(data=news, aes(x = news$rate_negative_words, y = shares)) + geom_point(stat = "identity") +

labs(x="Rate of Negative Words", y="Shares")

plot4 <- ggplot(data=news, aes(x = news$global_sentiment_polarity, y = shares)) + geom_point(stat = "identity") +

labs(x="Sentiment Polarity", y="")

plot1 + plot2 + plot3 + plot4

## Warning: Use of `news$n_unique_tokens` is discouraged. Use `n_unique_tokens` instead.

## Warning: Use of `news$rate_positive_words` is discouraged. Use `rate_positive_words` instead.

## Warning: Use of `news$rate_negative_words` is discouraged. Use `rate_negative_words` instead.

## Warning: Use of `news$global_sentiment_polarity` is discouraged. Use `global_sentiment_polarity` instead.

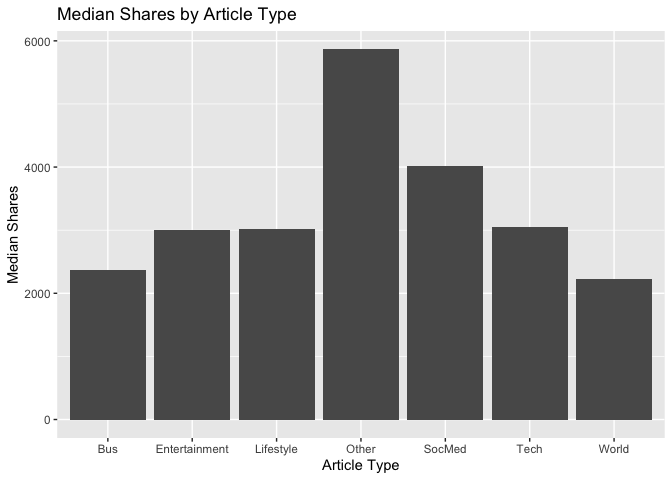

There are six different article subjects. It would be interesting to know if some subjects are more popular than others, so we can plot the median shares by the different article types.

news['article_type'] <- ifelse(news$data_channel_is_lifestyle == 1, "Lifestyle",

ifelse(news$data_channel_is_entertainment == 1, "Entertainment",

ifelse(news$data_channel_is_world == 1, "World",

ifelse(news$data_channel_is_bus == 1, "Bus",

ifelse(news$data_channel_is_socmed == 1, "SocMed",

ifelse(news$data_channel_is_tech == 1, "Tech","Other"))))))

ggplot(data=news, aes(x = article_type, y = shares)) + geom_bar(stat = "summary", fun.y = "median") +

labs(x="Article Type", y="Median Shares", title="Median Shares by Article Type")

## Warning: Ignoring unknown parameters: fun.y

## No summary function supplied, defaulting to `mean_se()`

# drop column used for plotting

news <- news %>% select(-article_type)

Modeling

There should be text describing the type of model you are fitting, your fitting process, and the final chosen model (this last part is to be automated so I don’t expect you to explicitly interpret that model, but you should be able to display something about the final model chosen on the training data).

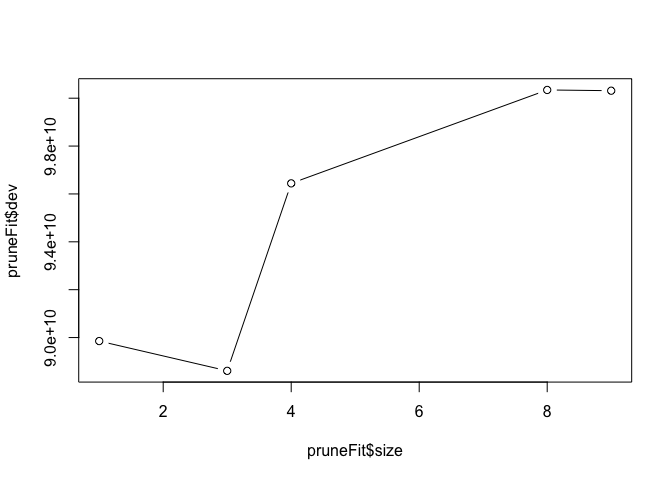

Regression Tree Model

The first model fit to the data will be a regression tree. We’ll use leave-one-out cross-validation to determine the optimal size of the model, as defined by number of splits. By plotting the fitted tree, we can see the deviance by tree size (larger deviance means a better fit).

treeFit <- tree(shares ~ ., data = newsTrain)

summary(treeFit)

##

## Regression tree:

## tree(formula = shares ~ ., data = newsTrain)

## Variables actually used in tree construction:

## [1] "kw_avg_avg" "self_reference_min_shares" "n_non_stop_unique_tokens" "n_tokens_title"

## [5] "n_unique_tokens" "kw_avg_max" "avg_positive_polarity"

## Number of terminal nodes: 9

## Residual mean deviance: 39160000 = 6.665e+10 / 1702

## Distribution of residuals:

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -38000.00 -1728.00 -1278.00 0.00 22.42 82880.00

pruneFit <- cv.tree(treeFit,

K=nrow(newsTrain)-1

)

pruneFitFinal <- prune.tree(treeFit, best = pruneFit$size[1])

plot(pruneFit$size ,pruneFit$dev ,type="b")

Boosted tree model

Next, we’ll fit a boosted regression tree. The boosted tree algorithm has a few hyperparameters, and we’ll use repeated 10-fold cross-validation to determine the optimal hyperparameter values. The hyperparameters of the optimal boosted tree is printed below, as well a summary of each fitted model.

fitControl <- trainControl(## 10-fold CV

method = "repeatedcv",

number = 10,

## repeated ten times

repeats = 5

)

boostedFit <- train(shares ~ ., data = newsTrain,

method = "gbm",

trControl = fitControl,

verbose = FALSE

)

boostedFit$bestTune

## n.trees interaction.depth shrinkage n.minobsinnode

## 1 50 1 0.1 10

boostedFit$results

## shrinkage interaction.depth n.minobsinnode n.trees RMSE Rsquared MAE RMSESD RsquaredSD MAESD

## 1 0.1 1 10 50 6657.000 0.03395868 2862.997 2403.522 0.03074098 452.6250

## 4 0.1 2 10 50 6772.467 0.02690501 2891.136 2391.239 0.02663976 457.0089

## 7 0.1 3 10 50 6822.695 0.02640529 2916.873 2362.163 0.02861856 430.3234

## 2 0.1 1 10 100 6688.743 0.03337363 2884.703 2368.378 0.03163360 446.6308

## 5 0.1 2 10 100 6871.507 0.02444774 2953.717 2340.634 0.02773099 446.7605

## 8 0.1 3 10 100 6960.542 0.02334665 3009.906 2310.783 0.02730471 431.1012

## 3 0.1 1 10 150 6717.032 0.03218936 2904.977 2363.676 0.03122142 448.1834

## 6 0.1 2 10 150 6950.738 0.02350822 3020.392 2308.608 0.02844442 449.8518

## 9 0.1 3 10 150 7067.250 0.02112297 3109.150 2263.746 0.02752012 442.2882

Linear regression model

Next, we’ll fit a multiple linear regression model on train data. Summary of the model is printed below.

linearfit<-lm(shares~.,data=newsTrain)

summary(linearfit)

##

## Call:

## lm(formula = shares ~ ., data = newsTrain)

##

## Residuals:

## Min 1Q Median 3Q Max

## -14883 -2173 -954 260 98350

##

## Coefficients: (2 not defined because of singularities)

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2.417e+03 2.629e+03 0.919 0.358002

## n_tokens_title -3.675e+01 8.299e+01 -0.443 0.657973

## n_tokens_content -2.704e-01 7.501e-01 -0.361 0.718515

## n_unique_tokens 4.710e+03 5.715e+03 0.824 0.409988

## n_non_stop_words -3.943e+03 4.853e+03 -0.813 0.416554

## n_non_stop_unique_tokens 5.960e+02 5.001e+03 0.119 0.905156

## num_hrefs 1.048e+01 1.836e+01 0.571 0.568214

## num_self_hrefs -2.426e+01 6.375e+01 -0.381 0.703615

## num_imgs 2.664e+01 2.751e+01 0.968 0.332942

## num_videos -2.758e+01 5.190e+01 -0.531 0.595183

## average_token_length -4.574e+02 7.231e+02 -0.633 0.527097

## num_keywords -9.067e+01 1.104e+02 -0.821 0.411677

## data_channel_is_lifestyle -1.341e+03 1.247e+03 -1.075 0.282380

## data_channel_is_entertainment -1.346e+03 7.704e+02 -1.747 0.080837 .

## data_channel_is_bus -1.911e+03 1.150e+03 -1.661 0.096811 .

## data_channel_is_socmed -1.070e+03 1.123e+03 -0.953 0.340908

## data_channel_is_tech -7.635e+02 1.096e+03 -0.697 0.485949

## data_channel_is_world -2.626e+03 1.126e+03 -2.331 0.019847 *

## kw_min_min 2.396e+00 4.904e+00 0.489 0.625251

## kw_max_min -2.890e-01 1.990e-01 -1.452 0.146606

## kw_avg_min 2.518e-01 1.210e+00 0.208 0.835150

## kw_min_max -7.296e-04 3.022e-03 -0.241 0.809227

## kw_max_max -5.872e-04 1.777e-03 -0.330 0.741160

## kw_avg_max -3.425e-03 2.478e-03 -1.382 0.167071

## kw_min_avg -3.397e-01 2.307e-01 -1.472 0.141083

## kw_max_avg -6.312e-02 8.048e-02 -0.784 0.432980

## kw_avg_avg 1.762e+00 4.580e-01 3.848 0.000123 ***

## self_reference_min_shares 3.831e-03 2.413e-02 0.159 0.873850

## self_reference_max_shares -1.840e-02 1.029e-02 -1.789 0.073759 .

## self_reference_avg_sharess 2.395e-02 3.068e-02 0.781 0.435130

## LDA_00 5.817e+02 1.366e+03 0.426 0.670282

## LDA_01 2.925e+02 1.525e+03 0.192 0.847893

## LDA_02 1.772e+03 1.366e+03 1.297 0.194857

## LDA_03 -9.546e+02 1.466e+03 -0.651 0.515022

## LDA_04 NA NA NA NA

## global_subjectivity 1.975e+03 2.450e+03 0.806 0.420437

## global_sentiment_polarity -2.990e+03 4.861e+03 -0.615 0.538607

## global_rate_positive_words -1.798e+04 2.170e+04 -0.828 0.407543

## global_rate_negative_words -6.828e+03 4.031e+04 -0.169 0.865505

## rate_positive_words 2.043e+03 3.309e+03 0.617 0.537038

## rate_negative_words NA NA NA NA

## avg_positive_polarity 1.721e+03 4.169e+03 0.413 0.679692

## min_positive_polarity -3.669e+03 3.365e+03 -1.090 0.275753

## max_positive_polarity 1.470e+03 1.278e+03 1.150 0.250378

## avg_negative_polarity 4.749e+03 3.656e+03 1.299 0.194132

## min_negative_polarity -2.660e+03 1.367e+03 -1.946 0.051816 .

## max_negative_polarity -1.231e+03 3.008e+03 -0.409 0.682275

## title_subjectivity -6.899e+02 8.891e+02 -0.776 0.437862

## title_sentiment_polarity 3.956e+02 7.448e+02 0.531 0.595364

## abs_title_subjectivity -1.525e+02 1.064e+03 -0.143 0.886096

## abs_title_sentiment_polarity 8.700e+02 1.254e+03 0.694 0.487807

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 6930 on 1662 degrees of freedom

## Multiple R-squared: 0.07087, Adjusted R-squared: 0.04404

## F-statistic: 2.641 on 48 and 1662 DF, p-value: 1.266e-08

Model Evaluations

Finally, we’ll evaluate the performance of each model by seeking the lowest root mean squared error of its predictions on the test dataset when compared to the actual values in the dataset. This should be a good approximation of the model’s performance on unseen data.

Regression Tree

Below is the RMSE of the optimal (non-ensemble) regression tree:

treePred <- predict(pruneFitFinal, newdata = dplyr::select(newsTest, -shares))

sqrt(mean((treePred-newsTest$shares)^2))

## [1] 9051.817

Boosted Trees

Below is the RMSE of the optimal boosted regression tree:

boostedTreePred <- predict(boostedFit, newdata = dplyr::select(newsTest, -shares))

sqrt(mean((boostedTreePred-newsTest$shares)^2))

## [1] 8498.582

linear regression

Below is the RMSE of the multiple linear model:

linearPred<-predict(linearfit, newdata=dplyr::select(newsTest, -shares))

sqrt(mean((linearPred-newsTest$shares)^2))

## [1] 8531.011